Introduction

Tax season—a phrase that often sends shivers down the spine of many Americans. The tax filing technique may be daunting, time-consuming, and, for a few, highly priced. Enter loose tax-submitting software, a beacon of desire for taxpayers seeking to simplify this annual duty without breaking the bank. However, the latest trends have overshadowed those loose services, with tech-rich person Elon Musk at the center of the controversy.

Background on Free Tax-Filing Software

Free tax-filing programs, such as the IRS's Direct File, had been designed to offer taxpayers a no-cost, honest approach to filing their tax returns. These systems' intention is to:

1) Cost Savings

Eliminate the need for paid tax instruction services, saving taxpayers money.

2) User-Friendly Experience

Offer intuitive interfaces that guide users through the submission process.

3) Direct Submission

Allow direct submission to the IRS, lowering processing instances.

The advent of these packages turned into a significant step closer to making tax compliance extra accessible to all Americans, regardless of their economic status.

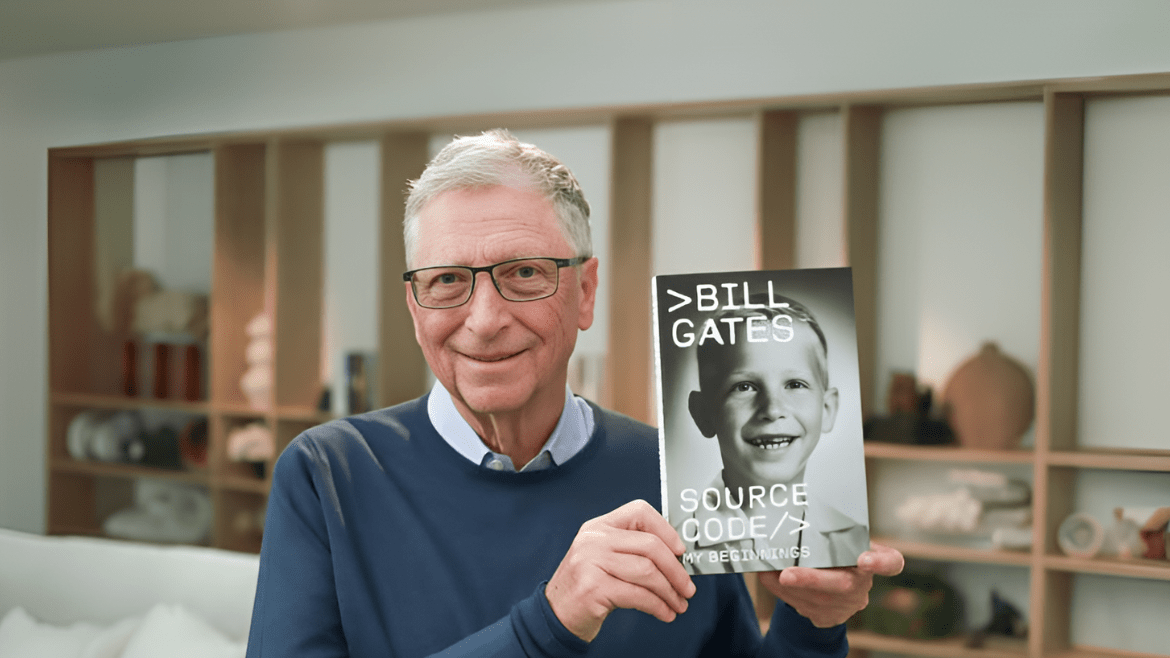

Elon Musk's Involvement in Government Efficiency

In a circle that amazed many, Elon Musk was appointed to guide the Department of Government Efficiency (DOGE). This newly installed branch was tasked with:

1) Reducing Government Waste

Identifying and eliminating useless costs.

2) Streamlining Operations

Improving the efficiency of federal businesses.

3) Innovating Public Services

Introducing technological solutions to modernize the authorities' functions.

Musk's popularity for innovation and disruption within the public sector made his appointment both fascinating and contentious.

Actions Taken Against 18F

One of Musk's first-rate moves as head of DOGE was targeting 18F, a virtual services enterprise in the General Services Administration (GSA). Established in 2014, 18F played a pivotal role in growing the IRS's Direct File software. However, below Musk's directive:

1) Disbandment of 18F

The employer was dismantled, and about ninety personnel were laid off.

2) Rationale Provided

The move was provided as part of broader efforts to reduce government inefficiencies and reduce federal workforce redundancies.

This selection raised alarms approximately the destiny of unfastened tax-filing services.

Impact on the IRS's Direct File Program

The abrupt disbandment of 18F caused vast confusion regarding the fate of the IRS's Direct File application:

1) Continued Availability

Despite initial concerns, the Direct File application stays operational for the modern tax season.

2) Public Uncertainty

Mixed messages and a lack of clear conversation have left many taxpayers unsure of the provision of loose filing alternatives.

This uncertainty underscores the need for transparent communication from authorities and businesses.

Reactions from Taxpayers and Advocacy Groups

The capability risk to free tax-submitting services has elicited robust reactions:

1) Taxpayer Concerns

Many worry about elevated charges and complexities in submitting taxes without loose alternatives.

2) Advocacy Groups

Organizations advocating for customer rights have criticized the circulation, emphasizing the importance of available tax-filing offerings for all.

These reactions highlight the essential role such programs play in selling monetary equity.

Commercial Tax Preparation Industry's Perspective

The industrial tax training industry, ruled by agencies like TurboTax and H&R Block, has a vested interest in the landscape of tax-filing services:

1) Competitive Concerns

Free authorities-provided offerings pose a direct hazard to their business models.

2) Lobbying Efforts

These companies have traditionally lobbied against the expansion of free tax-filing options, aiming to protect their market share.

The anxiety between public services and private agencies is evident in this area.

Political Responses and Debates

The tendencies have sparked debates amongst policymakers:

1) Support for Efficiency Measures

Some lawmakers have backed Musk's projects to lessen the authorities' spending.

2) Opposition to Cuts

Others argue that casting off free tax-submitting offerings disproportionately harms lower-income taxpayers and benefits company interests.

These debates highlight the wider ideological divide concerning the role of government in providing essential services.

Potential Motivations Behind Musk’s Actions

The motive behind Musk’s push in opposition to the loose tax-return software program is multifaceted. Several potential motivations encompass:

1) Government Spending Reduction

Musk has long recommended cutting government inefficiencies. Eliminating applications like Direct File may also align together with his broader imaginative and prescient of leaner federal forms.

2) Tech-Driven Tax Innovations

Musk may be pushing for a privatized, tech-driven approach to tax submitting. This may open the door for brand-new AI-powered tax-submitting answers evolved using private corporations.

3) Industry Influence

Critics speculate that Musk’s decision benefits industrial tax-filing businesses, which have lengthy adverse unfavorable tax software.

4) Personal Ideological Views

Musk has regularly criticized authorities overreach and inefficiency. His decision to dismantle 18F may additionally stem from a perception that the private zone can provide higher answers.

These opportunities raise concerns about whether or not this move is honestly about performance—or if there’s a hidden agenda at play.

Implications for Low-Income Taxpayers

If free tax-filing services are removed or limited, low-profit taxpayers could face giant challenges:

1) Increased Financial Burden

Many can be pressured to pay for tax training offerings, adding a pointless expense.

2) Accessibility Issues

Without unfastened alternatives, taxpayers with restrained virtual literacy or access to expert assistance may additionally battle to report effectively.

Potential for Higher Errors and Penalties

More complicated submission techniques increase the risk of mistakes that could result in audits or consequences.

The potential effects highlight why free tax-filing offerings are a crucial resource for thousands and thousands of Americans.

Future of Free Tax-Filing Services

Despite the contemporary uncertainty, the destiny of free tax-submitting software programs remains an open question:

1) Legislative Pushback

Lawmakers who guide tax-filing accessibility might also introduce payments to reinstate or amplify loose options.

2) Alternative Digital Services

Other government agencies or 1/3-celebration organizations may also step in to expand new free tax-filing services.

3) Public Pressure

Widespread public dissatisfaction with the removal of unfastened tax-filing alternatives should prompt policymakers to take a different course.

Whether these services will be preserved relies on political will and public advocacy.

Global Perspectives on Tax-Filing Systems

The U.S. Tax-submitting gadget is significantly more complicated than those in many different countries. Some global examples include:

1) United Kingdom & Japan

The authorities pre-fill tax returns, and most people need to verify their information.

2) Estonia

Advanced digital tax systems allow for tax submissions in under 5 minutes.

3) Scandinavian Countries

Citizens do not often need to file taxes, as the government handles it automatically.

These examples propose that the U.S. May want to undertake a more taxpayer-friendly gadget, lowering the need for non-public tax instruction offerings.

Technological Innovations in Tax Filing

The rise of AI and automation should revolutionize tax submitting, with improvements including:

1) Automated Tax Calculations

AI-powered structures that robotically prepare and document taxes based on monetary records.

2) Blockchain for Secure Tax Transactions

Decentralized ledgers ensure relaxed, obvious tax filing.

3) Government AI Assistants

Virtual assistants that help manual taxpayers with the submission process.

If applied efficaciously, that technology should reduce reliance on 0.33-birthday celebration tax preparers and make filing easier for each person.

Public Opinion and Trust in Government Services

Public trust in authorities' offerings performs a vital function in the debate over loose tax-filing software:

1) Loss of Trust in Government Efficiency

Many see the removal of Direct File as a step backward in the authorities' modernization.

2) Concerns About Corporate Influence

Some worry that non-public tax-submitting agencies wield an excessive amount of power over policy choices.

3) Desire for Simplicity

A developing range of Americans assist a tax gadget that is more truthful and price-effective.

How the authorities handle tax-submitting services shifting forward will affect public self-belief in their capacity to serve taxpayers.

Conclusion

Elon Musk’s involvement in the dismantling of 18F and potential threats to unfastened tax-filing software have sparked huge controversy. While proponents argue that cutting authorities' inefficiencies is necessary, critics warn that such actions disproportionately harm low-income taxpayers and benefit commercial tax preparers.

The destiny of loose tax-filing services remains unsure, but public advocacy and political action may additionally decide whether Americans maintain to have get admission to to no-cost tax coaching options. As debates persist, one query remains: Will taxpayers win, or will personal pursuits dictate the future of tax filing in the U.S.?

Frequently Asked Questions

1. Why changed into 18F disbanded under Musk's management?

Musk’s Department of Government Efficiency (DOGE) aimed to reduce federal personnel redundancies, main to the closure of 18F. However, critics argue that this move by and large benefits personal tax-submitting groups.

2. Will the tax-filing software program nevertheless be available this year?

Yes, the IRS’s Direct File application stays operational for this tax season, however, its future beyond that remains unsure.

3. What are the alternatives if free tax-filing packages are removed?

Taxpayers may additionally have to depend on business tax preparers, volunteer tax help packages, or self-filing using paper forms.

4. Are other countries' tax structures less difficult than the U.S.?

Yes, many countries have simplified tax systems in which the authorities pre-fill tax returns, requiring minimal input from taxpayers.

5. How can taxpayers recommend free tax-filing services?

Public pressure through petitions, contacting representatives, and supporting legislation aimed at reinstating unfastened submitting applications can impact coverage choices.