Introduction

Artificial Intelligence (AI) is revolutionizing industries globally, with organizations investing billions into AI-powered answers. From automation to device mastering, AI is reworking the way corporations function. While most traders' attention is on tech giants like Google, Microsoft, and Nvidia, there is an ignored area poised for exponential growth. This hidden opportunity isn't only profiting from AI but also reworking whole industries in approaches few human beings have considered. With AI-powered answers turning into a necessity, early buyers in this quarter may want to see massive returns.

In this text, we’ll dive deep into how AI is reshaping the inventory marketplace, pick out the sector that might be the largest winner, and spotlight key businesses poised for growth. If you're looking for the following huge funding opportunity in AI, this is what you need to pay attention to. to

The AI Revolution and Its Market Impact

1) The Growth of AI Technologies

AI has advanced drastically over the last decade, transferring beyond simple automation to complicated system studying, deep learning, and neural networks. Companies are integrating AI into the whole lot from customer support chatbots to superior robotics and self-driving cars.

The increasing strength of AI is driven by several elements:

The rise of cloud computing permits businesses to process massive quantities of data.

More effective AI chips from businesses like Nvidia and AMD.

Widespread adoption of AI in industries like healthcare, finance, and production.

The AI revolution is accelerating, and businesses that fail to evolve risk falling behind. This technological shift is creating beneficial investment opportunities, with AI-associated shares seeing a massive increase in recent years.

2) AI's Disruption in Traditional Markets

AI isn't simply improving performance—it’s essentially changing industries. In finance, AI algorithms are replacing conventional stock buyers. In healthcare, AI-powered diagnostics are outperforming human medical doctors. Even in innovative industries, AI-generated content is becoming more commonplace.

Some of the biggest disruptions consist of:

1. Retail

AI-driven inventory management and customized advertising and marketing.

2. Transportation

Autonomous vehicles decrease reliance on human drivers.

3. Manufacturing

AI-powered automation leads to fewer manual exertion jobs.

These shifts are developing new funding possibilities, particularly for corporations leveraging AI to advantage a competitive facet.

The Stock Market Sectors Benefiting from AI

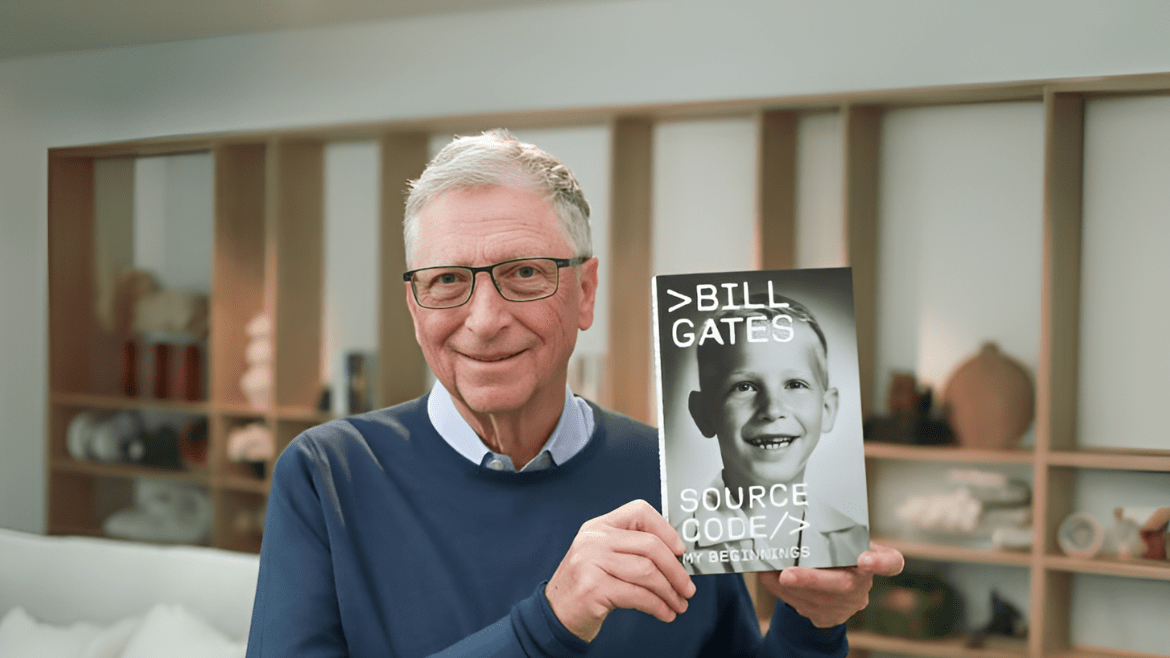

1) Tech Giants Leading the AI Race

When humans think about AI, companies like Google, Microsoft, and Nvidia come to mind. These tech giants are investing billions into AI studies and improvement, giving them a stronghold inside the market.

For instance:

1. Google (Alphabet)

AI-pushed search and cloud computing.

2. Microsoft

AI-powered productivity equipment and cloud AI solutions.

3. Nvidia

Leading in AI chip generation.

These companies have visible outstanding inventory growth as AI adoption speeds up. However, the most important profits may also lie in a sudden region that’s simply beginning to take off.

2) Unexpected Sectors Profiting from AI

Beyond big tech, several industries are quietly taking advantage of AI. These consist of:

Healthcare: AI-pushed drug discovery and diagnostics.

1. Cybersecurity

AI-powered chance detection.

2. Energy

AI optimizing electricity grids and electricity efficiency.

While those sectors are growing, one sector is poised to be the biggest winner of the AI boom.

The Hidden Stock Market Sector Poised for Explosive Growth

1) Identifying the Underrated AI Winners

The zone that stands proud the most? AI-powered infrastructure and commercial automation. While most people are aware of software program-based AI organizations, the need for the need pushed infrastructure is skyrocketing.

1. Why is this zone overlooked?

It’s no longer as flashy as AI software organizations.

Many buyers don’t recognize how critical AI-powered infrastructure is.

Companies in this sector are frequently conventional commercial corporations adapting to AI.

2) The Role of AI in This Sector’s Growth

AI is getting used to optimize the whole thing from logistics to predictive preservation in industries like creation, manufacturing, and delivery chain control. Companies are using AI to enhance infrastructure and are seeing performance gains, which, without delay, impact profitability.

1. Some key growth regions encompass:

AI-powered robotics in production.

Smart infrastructure in towns and transportation.

AI-driven logistics and supply chain optimization.

With AI remodeling those industries, investors who recognize the potential early may want to see those sizable gains.

Key Companies to Watch in This Sector

1) High-Growth AI-Driven Stocks

Several companies within the AI-powered infrastructure and commercial automation sector are emerging as main players. These agencies are leveraging AI to optimize operations, reduce charges, and enhance efficiency. Here are a number of the key stocks to look at:

1. ABB Ltd (NYSE: ABB)

A global leader in business automation, ABB is using AI-driven robotics to revolutionize production and logistics.

2. Siemens AG (OTC: SIEGY)

Siemens integrates AI into smart infrastructure, assisting in creating smart homes and cities.

3. Rockwell Automation (NYSE: ROK)

Focused on commercial automation, Rockwell is using AI to improve productivity in manufacturing.

4. Honeywell International (NASDAQ: HON)

A diversified enterprise applying AI in areas like smart homes, supply chain automation, and aerospace.

5. UiPath (NYSE: PATH)

A leader in robotic process automation (RPA), UiPath is automating enterprise procedures with AI.

These groups might not be as well-known as Google or Microsoft, but they may be playing an essential role in AI's expansion into real-world applications.

2) Why These Companies Have an Edge

Unlike software program-focused AI companies, those infrastructure and automation firms have a tangible impact on worldwide industries. Here’s why they have an aggressive edge:

1. Scalability

AI-driven automation is being adopted across multiple industries, from logistics to healthcare.

2. Cost Reduction

AI enables groups to cut operational costs, making them more worthwhile over time.

3. Government Support

Many governments are investing in AI-pushed infrastructure projects, benefiting these companies.

4. Barriers to Entry

Unlike software, AI-pushed infrastructure calls for a great investment, making it tougher for brand-spanking new competitors to go into the distance.

As AI adoption continues to grow, those agencies are located to supply great returns for traders.

Risks and Challenges in Investing in AI Stocks

1) Market Volatility and AI Stocks

AI shares, like many rising technologies, may be incredibly unstable. Here’s why:

1. Speculation-Driven Growth

Many AI stocks are valued based on destiny potential rather than present-day profits.

2. Economic Downturns

A recession may slow AI investments, impacting inventory costs.

3. Competitive Pressure

As more groups enter the AI area, competition may affect profit margins.

Investors need to control risk by diversifying their portfolios and specializing in AI businesses with sturdy basics.

2) Regulatory and Ethical Concerns

Governments are tightening AI regulations due to worries about privacy, safety, and task displacement. Some key issues consist of:

1. Data Privacy Laws

Stricter guidelines may additionally limit AI’s potential to research large datasets.

2. AI Bias and Ethics

Companies failing to address AI bias problems may also face court cases or reputational damage.

3. Government Oversight

Countries just like the U.S. and China are growing AI oversight, which can affect innovation.

Despite these challenges, AI remains a transformative force, and companies that navigate these dangers wisely will emerge stronger.

Conclusion

The AI boom is some distance from over, and whilst tech giants dominate the headlines, the actual hidden opportunity lies in AI-powered infrastructure and commercial automation. This area is rapidly growing as agencies look for methods to combine AI into real-world applications.

Companies like ABB, Siemens, Rockwell Automation, and Honeywell are quietly leading the way, supplying traders with a risk to capitalize on the next wave of AI-pushed boom.

While AI shares include dangers, people who invest strategically in this hidden area may want to see significant returns within the coming years. If you are looking for the largest winner of the AI boom, industrial automation, and smart infrastructure might just be the solution.

FAQs

What is the pleasant stock market zone to invest in for AI?

While tech giants dominate the AI enterprise, the AI-powered infrastructure and business automation area offers a hidden possibility for full-size growth. Companies in this area are leveraging AI to beautify actual global programs like smart towns, robotics, and supply chain automation.

Are AI-pushed stocks a safe investment?

AI stocks can be unstable because of hypotheses and evolving guidelines. However, organizations with strong basics, actual-international applications, and authority backing (together with those in industrial automation) offer more balance than speculative AI startups.

How can I become aware of hidden possibilities within the AI area?

Look for industries wherein AI adoption is still in the early stages, however, has the capability for tremendous growth. Infrastructure, production, and logistics are top examples of sectors that might be quietly making the most of AI without much media interest.

Which industries are most affected by AI disruption?

AI is reshaping industries like finance, healthcare, retail, transportation, cybersecurity, and business automation. While software AI receives the maximum attention, infrastructure-related AI applications are becoming increasingly important.

What are the dangers of investing in AI-associated shares?

AI-related shares face demanding situations including market volatility, regulatory modifications, ethical concerns, and fast technological evolution. Investors need to conduct thorough research and diversify their portfolios to mitigate those dangers.